Your leaky online payment process

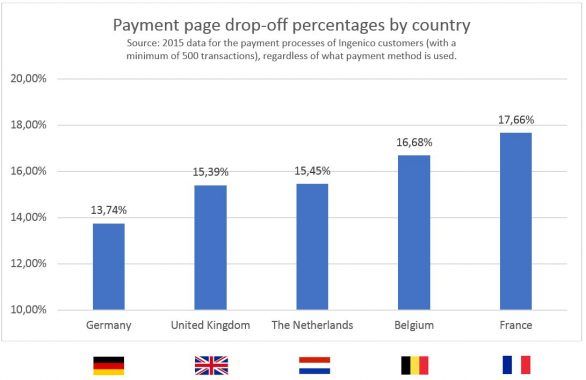

According to figures from Ingenico, around 15% of site visitors in the Netherlands that begin the payment process do not complete their transaction. This can have many causes which will be examined later in this article. So why are these visitors leaving websites one step removed from completing the transaction and making the purchase that they intended to make? Your website is leaking and there is a big possibility that you are not aware of it!

Little has been written regarding the optimization of the payment process (the process that happens after your customers press the “buy” button and are often redirected to an external domain). This needs to change! And so, Jorden Lentze (Google – at that time), Luc Bleylevens (Ingenico) and Denise Visser (bol.com) decided to work on this article in an unique partnership. This article is the result of this partnership and is based on a payment page.

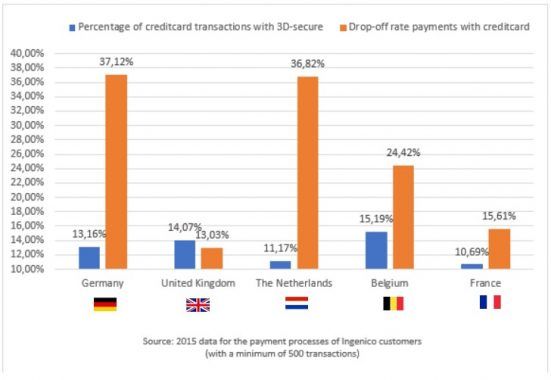

The drop-offIn the overview below, the average drop-off percentages are shown for Germany, UK, The Netherlands, Belgium and France. In the Netherlands, the drop-off rate is 15%, which is also typical in comparison with neighboring countries.

Do you know the drop-off rate that applies to your payment process? Are you the drop-off rate is not also 15%? What are the causes of drop-offs and what are the solutions? This article will address these questions.

What conversion percentage can be expected?

The challenge here is that the figures for drop-offs in the payment process are usually not retrievable from your web analytics package as this part of the journey does not take place on your website but often on an external domain.This makes it practically impossible to see the difference between customers who change their minds at the payment page on your website or those who do not complete the payment process at the external payment provider. Because in your analytics tool you can only measure what happens on your website. Not what happens on the domain of your PSP. These figures can be requested from your Payment Service Provider (PSP).

Independent of the structure of the checkout flow the drop-off can occur in another location.

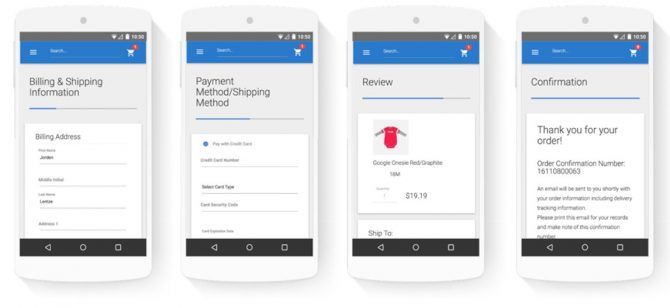

In the example below the checkout consists of 4 steps: details page, payment page, summary and order confirmation.

In this example, the drop-off percentage is highest at the payment page. Usability is often the cause of this. Drop-offs related to issues such as insufficient funds or technical problems are allocated to the review page which is not correct.It is important to realize that not everything is related to the layout of webpages. This is especially the case if you do not have a review step and customers are taken to the order confirmation page directly after entering their payment details. If the customer has inadequate funds available, the transaction cannot go ahead regardless of how effective the website might be.

An illustration shows WHERE the drop-off is located but not WHY it is happening. Based on the tips that this article provides you should look for any areas of improvement in your website.

A conversion consists of different steps. At each step there is a possibility of drop-off.

*source: example data from Google Analytics at https://www.googlemerchandisestore.com

Establishing the context: What is a Payment Service Provider?

Your Payment Service Provider is the company that facilitates all the payments on your website. They ensure that all payments between customer and website can take place safely and efficiently.

This is often recognizable as the moment in the payment process where customers leave the website and, for safety reasons, are redirected to another domain (for example the bank or credit card company).

Establishing the context: The difference between payment process and payment page

- Payment page: choose payment method

- Payment process: (precise steps differ per payment method)

- Login for payment method

- Select account

- Agreement

- Confirmation

- Confirmation at the webshop

Step 2 occurs at the PSP and/or bank

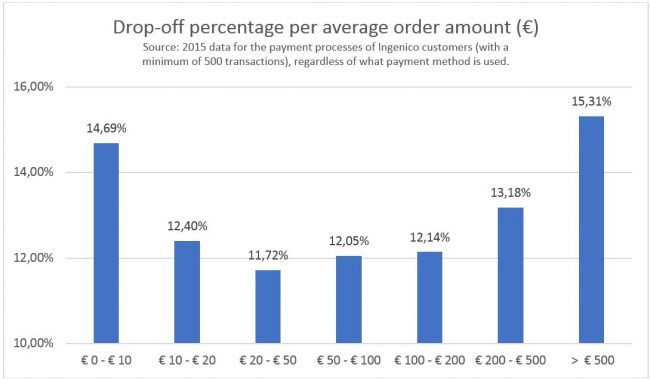

If we look at the data from Ingenico we can see a large difference per order amount. Drop-off is highest with small amounts and very large amounts.

As shown in the image, the conversion of amounts between 20 and 50 euros is most effective. Lower amounts have a poorer conversion mostly because the delivery cost share is usually the highest for smaller orders.

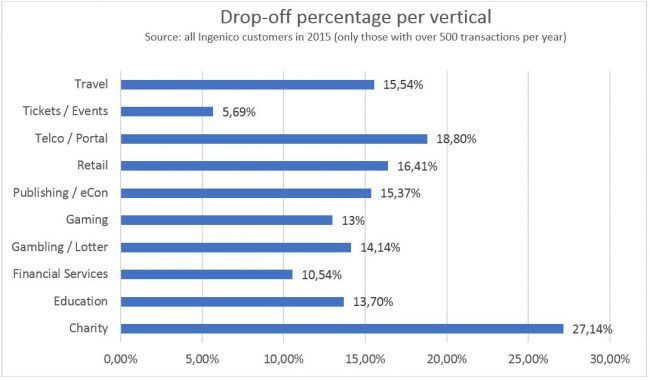

The type of product can also determine the expected conversion.

Once you know two things:

- how effective is your payment process, as far as conversion is concerned

- what conversion your payment process has

Then, it is a good idea to ask yourself if any improvements are possible.

Tips to improve the conversion of your payment page

Below we will share several tips for improving your payment page so that you will help you improve the drop-off rate of 15% in your payment process.

These tips are not prioritized. It is simply a case of selecting those that best apply to your situation. It is important to have as much knowledge as possible about what is actually happening (tips 1, 2 and 3).

Tip 1: Analyze visitor data

To get more accurate insights regarding the conversion on your payment page it is wise to study the drop-off figures. As mentioned earlier, in most cases you will need some assistance from your PSP with this. Only looking at averages gives inadequate insights, especially with large volumes. Relevant segments should be made so that you can learn more about visitor behavior. AB testing of new solutions should also help you to understand what motivates customers.

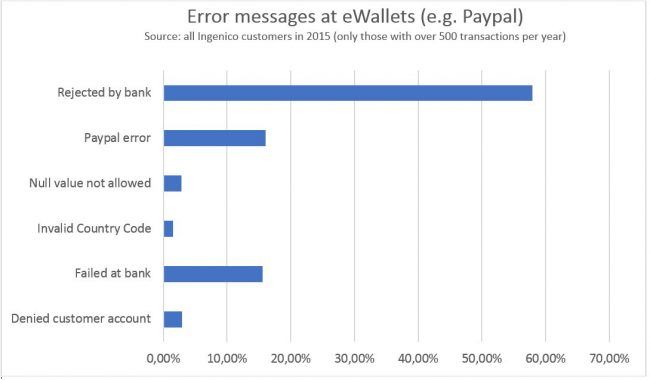

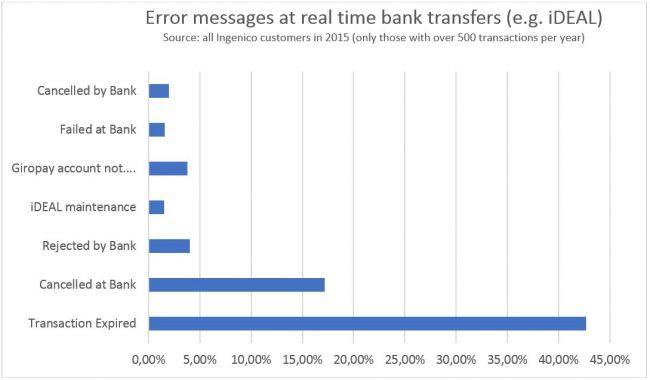

Tip 2: Study error messages

Obviously not every payment proceeds without error. Analyzing the error messages reported by the PSP gives insight into where most visitors encounter difficulty. There is most likely a technical issue at the root of this that can be solved. In the graphs below just some examples of error messages on an ordinary day.

Tip 3: Learn from customer service contacts

Check with customer service why customers contact them regarding payment issues. Functionalities such as online chat in the checkout process will help you establish what difficulties customers encounter with payment.

Qualitative usage research in testing a solution is also effective. This can give a good indication of whether the chosen solution can be successfully implemented.

Tip 4: Ensure a reliable look and feel

When spending their money online, visitors need to feel comfortable and safe. This concerns spending money and (for example) entering their credit card details.

- Make it clear that the page is encrypted with SSL. SSL is standard with any Payment Service Provider. This is visible whenever https is displayed in the URL.HTTPS is increasingly becoming the standard operating procedure for entire websites. The Google Chrome browser indicates websites that do not make use of HTTPS as potentially unsafe. From 1st January 2017 Google has warned Chrome users about the risks of entering sensitive information on non-HTTPS sites. You can read more about this here.

- Ensure that the payment page is visibly connected to the webshop (in terms of style and layout) to ensure consistency and avoid alarming the visitor with a different appearance.

- Add logos of well-known payment brands and methods.

- Make it clearly visible to the customers what they are buying: display the selected products on the payment page. Also ensure transparency on related costs and when these apply.

Provide adequate context about what is going to happen. Display clear labels on buttons that explain what happens if a visitor clicks on them.

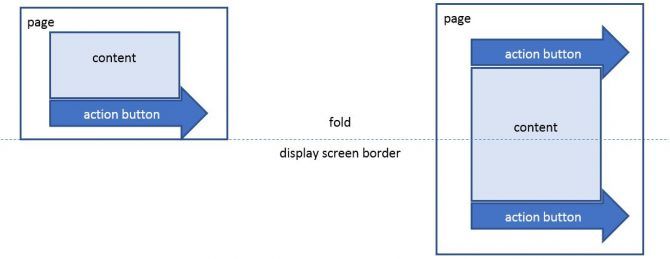

And never display two identical buttons with the same text on the same screen. Sometimes a payment button is displayed at the top and bottom of the page, with the contents of the shopping basket between them. Ensure that just one button is visible in the viewport.

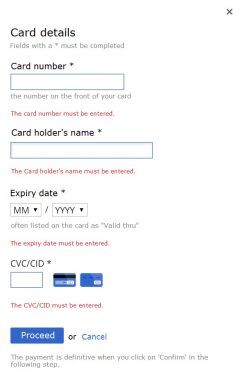

Tip 5: Make it easy to correct errors

Provide clear instructions on how to complete the required fields and if the visitor encounters an error message make it clear how they can resolve any problem.

Tip 6: Number of payment methods

More is not always better. More options can create tension. Ensure that the payment methods that are used correspond to the target market.

Try to limit the number of payment methods listed at any one time to four or fewer.

Keep track of new payment methods, such as Apple Pay and Google Pay, which are both on the market but not yet available in The Netherlands.

Tip 7: The list order of payment methods

Choose a logical order for listing payment methods, with the most used listed at the top. Ensure the payment methods are recognizable by using their respective logos.

Tip 8: Choose the right payment level

How sure do you want to be of receiving your payment before you ship the product or provide the service? There are different ways to ensure more protection and applying 3D secure is an example of this. After the customer enters their credit card details an extra password is requested. The requesting of a 3D secure code reduces the chance that an order is paid for using a stolen credit card. Adding this extra question does however lead to an increased chance of drop-off. Each webshop owner needs to weigh up the risk of a higher drop-off caused by increased security. 3D secure is an international standard.

The credit card drop-off rate for 3D secure is often higher in The Netherlands as Dutch consumers generally have less trust in using credit cards and 3D secure.

Tip 9: Make it context independent / Act local

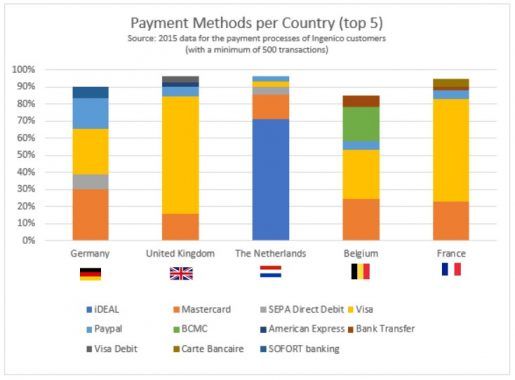

Which countries do your customers come from and which payment methods are popular? iDeal is an absolute condition for success in the Dutch market while in Belgium – alongside credit card – Bancontact is essential. Credit card is the most widely used method in Germany, but PayPal is firmly established in the Top 3 as well. Ensure that the payment methods you offer correspond to the popular payment methods used by your target market.

The figures below show the most popular payment methods per country.

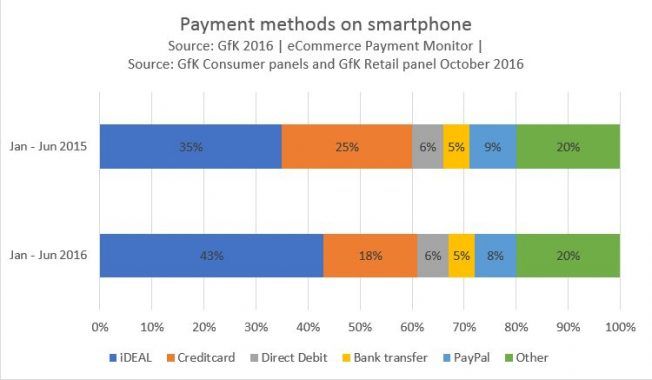

Tip 10: Ensure that payment methods work on all devices

Mobile traffic is increasingly important for most websites. Sometimes around half of a site’s visitors are already using mobile devices. It is important to ensure that these visitors experience an error free payment process. Integration with banking apps ensures a straightforward transaction. In fact, an iDEAL transaction on a mobile phone is even easier than on a desktop (the share of iDEAL transactions being made on mobile devices is steadily increasing – see image below). Take this into consideration when determining the correct order of payment methods per device, this can be different on a mobile device to a desktop.

Check the ratio between desktop and mobile visitors for your website and any changes in this over time. Be prepared and do not allow yourself to be surprised by the increasing use of mobile devices.

Tip 11: Make things easier for returning customers

Tokenization - also known as one-click payment - can make payments easier for returning customers. With their first payment the customer’s payment data (e.g. Credit card number) is saved by the PSP. The PSP then sends a unique key (token) back. This unique key is saved by the webshop and linked to the customer account. On their next visit to the webshop this token is offered to the PSP and the customer does not have to fill in their credit card details again. An extra request such as a 3D secure passcode is also not required.

Tip 12: Ensure a fast transaction

This applies to your whole website but loading time has a clear influence on conversion. If a visitor must wait too long during the payment process there is an increased drop-off chance. During any waiting time it is a good idea to display information on progress. In any case information on what is happening should be displayed, for example by showing a loader.

It is also essential to prevent your visitor being burdened with extra items that are not necessary for the completion of their transaction. The number of steps and questions should be limited as much as possible. An example here is that choosing the type of credit card is unnecessary, the type can be recognized from the number of the card

Tip 13: Keep the shopping basket until the payment has been completed

If a visitor begins the payment process and reaches the payment method selection stage and at which time the transaction is prematurely terminated, then the visitor is returned to the webshop.

Ensure that the shopping basket remains intact after any unsuccessful payment attempt. This allows the visitor to choose another payment method and subsequently complete the transaction.

Tip 14: A/B test all changes

This is perhaps the most important tip: it is essential to a/b test any changes to be certain that they are indeed improvements. Because on average, 30% of A/B tests is successful. This then also means that if you do not a/b test, there is a 70% chance that if you implement a change on your website it will have no or a negative impact on your revenue.

And do not copy the things you see on other websites. There is a big chance they have also not a/b tested is. And what works for one company might not work with yours. It can also be a competitive advantage if a rival company has not tested their changes.

What can you ask from your supplier?

PSPs are often functionally orientated, as they need to be. They must ensure that payments can take place. This means they are concerned with uptime and response times. The site visitor expects that functionality works and is not interested in technology behind the scenes (as a webshop owner your perspective is probably similar as this is a service you are paying for)

The PSP also arranges PCI compliancy. This the international standard for credit card payments and applies worldwide.

Ensure that the out-of-the-box implementation is improved by (for example) CSS adjustments. Often these minimal adjustments are overlooked.

The PSP has a great deal of information concerning the success of your payment page. Ensure that you have knowledge of this data.

Getting started!

We wish you the best of luck with applying these tips and improving the performance of your payment page.

A payment page with better conversion creates enthusiasm for everyone involved.

- The customer can execute a transaction more easily.

- The webshop can increase their revenue.

- The PSP receives more commission from successful transactions.

Let us know your experiences!

Remarks

This article is the initiative of a unique partnership between Jorden Lentze (Google), Luc Bleylevens (Ingenico) and Denise Visser (freelancer / bol.com). During writing we were often tempted to broaden the scope of the article. We would love to hear what other items readers would like us to cover. Pose your question as a response to this article.

Goals

- Sharing greater insight into part of the funnel that is less well known to many people (and to illustrate that there are data sources that help with this)

- Awareness of the payment component

- An extra chance to improve conversion (by yourself, or in collaboration with PSP)

Target audience: eCommerce managers / CRO specialists / Conversion managers

This article is based on a payment page – only the payment will be made on this page. Delivery details will be requested at another stage in the process.